Searching for an ACH Stop Payment Form but didn’t find any?

Most of the forms you see are in PDF format, which means you can’t edit them.

While some good quality templates are available on Etsy, they are all premium and require payment for access.

To save you time, money, and hassle, I have designed two ACH Stop Payment Form templates.

These templates are made in Google Docs, meaning they can be customized as needed.

The best part?

They are completely free!

If you’re also looking to stop or change future payroll deposits, check out this free Direct Deposit Authorization Form Template.

Usage Note: These templates are free to use for both personal and commercial purposes. However, redistribution, resale, or uploading these templates to other websites or platforms for download or sale is strictly prohibited. Please respect the effort that went into creating these resources by using them responsibly.

What is an ACH Payment?

Before I show you the templates, I would like to quickly clarify what an ACH payment is. If you’re already familiar with it, you can skip this part and jump directly to the template.

ACH stands for Automated Clearing House, a secure electronic network for financial transactions mostly used in the United States.

This is how many companies process direct deposits like your paycheck, and also direct debits like your utility bills, gym memberships, etc.

These payments are automated, which makes them convenient, but a situation can arise where you might want to stop them. This is when the ACH Stop Payment form comes in.

If you’re dealing with ACH withdrawals linked to an employee loan, you might also find this Employee Loan Agreement Template helpful to document terms clearly.

Why Would You Need an ACH Stop Payment?

As mentioned earlier, while these payments are convenient as they are automated, there can be several reasons you might need to initiate an ACH stop payment.

Below, I have listed a few common reasons:

- Unauthorized Transactions

- Canceled Services/Subscriptions

- Billing Disputes

- Fraudulent Activity

- Budget Management

In case you’re disputing charges tied to a line of credit, consider using this Promissory Note Line of Credit Agreement Template for your records.

How to Use These Templates

These templates are designed in Google Docs, which means you need to have a Google Account first.

If you don’t have a Google Account, you need to create one so that you can use these free templates.

If you already have a Google Account, simply log in to it and then follow these easy steps:

- Choose the template that you want to use.

- Below the template preview images, you will see a black button that says “Go to template”; click on it.

- You will be directed to the template preview page.

- Click on the “USE TEMPLATE” button.

- You’ll now have your own editable version of the template.

- Make the necessary changes or use the form as it is.

- Fill it out online and then print the form, or print it and then complete it by hand.

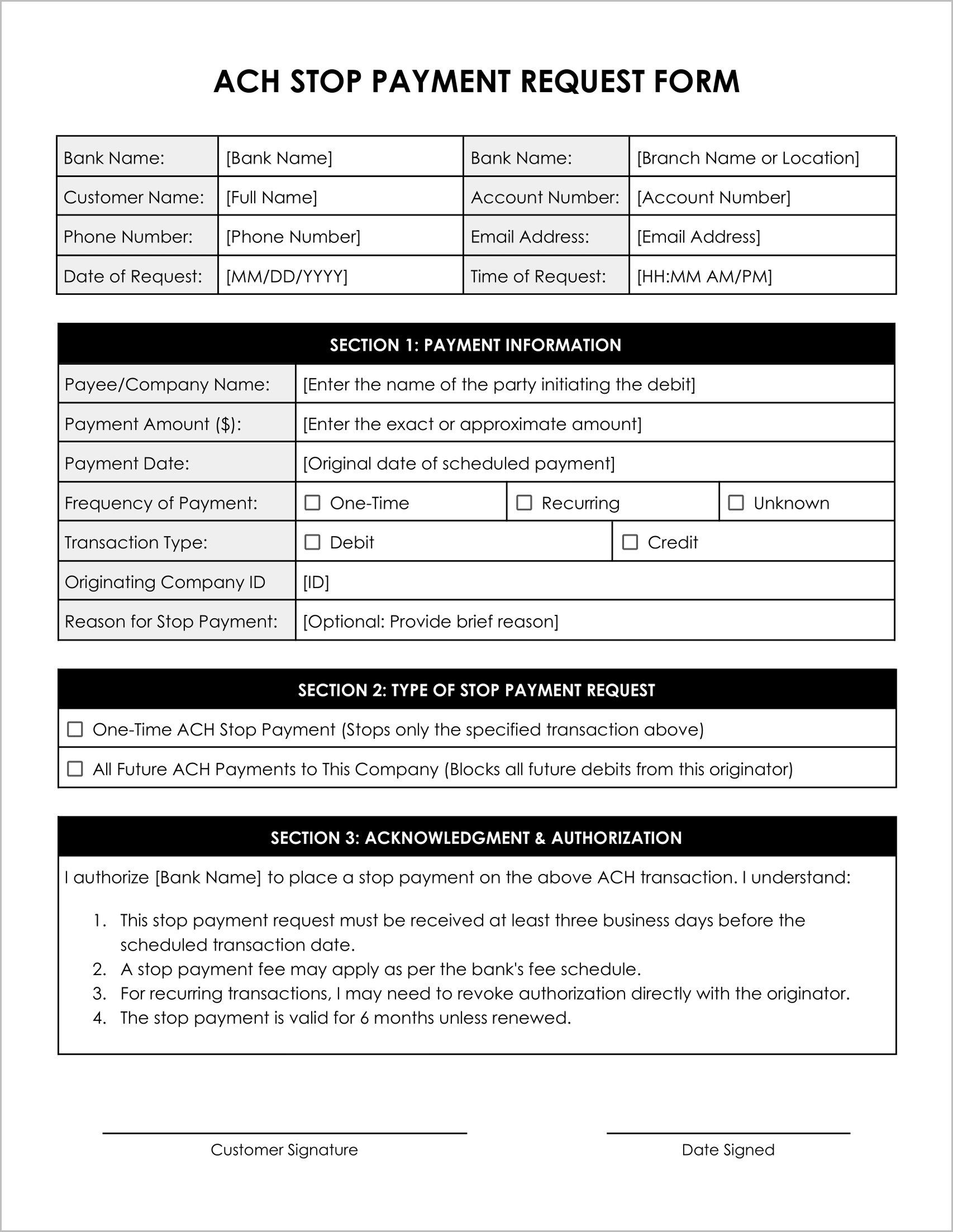

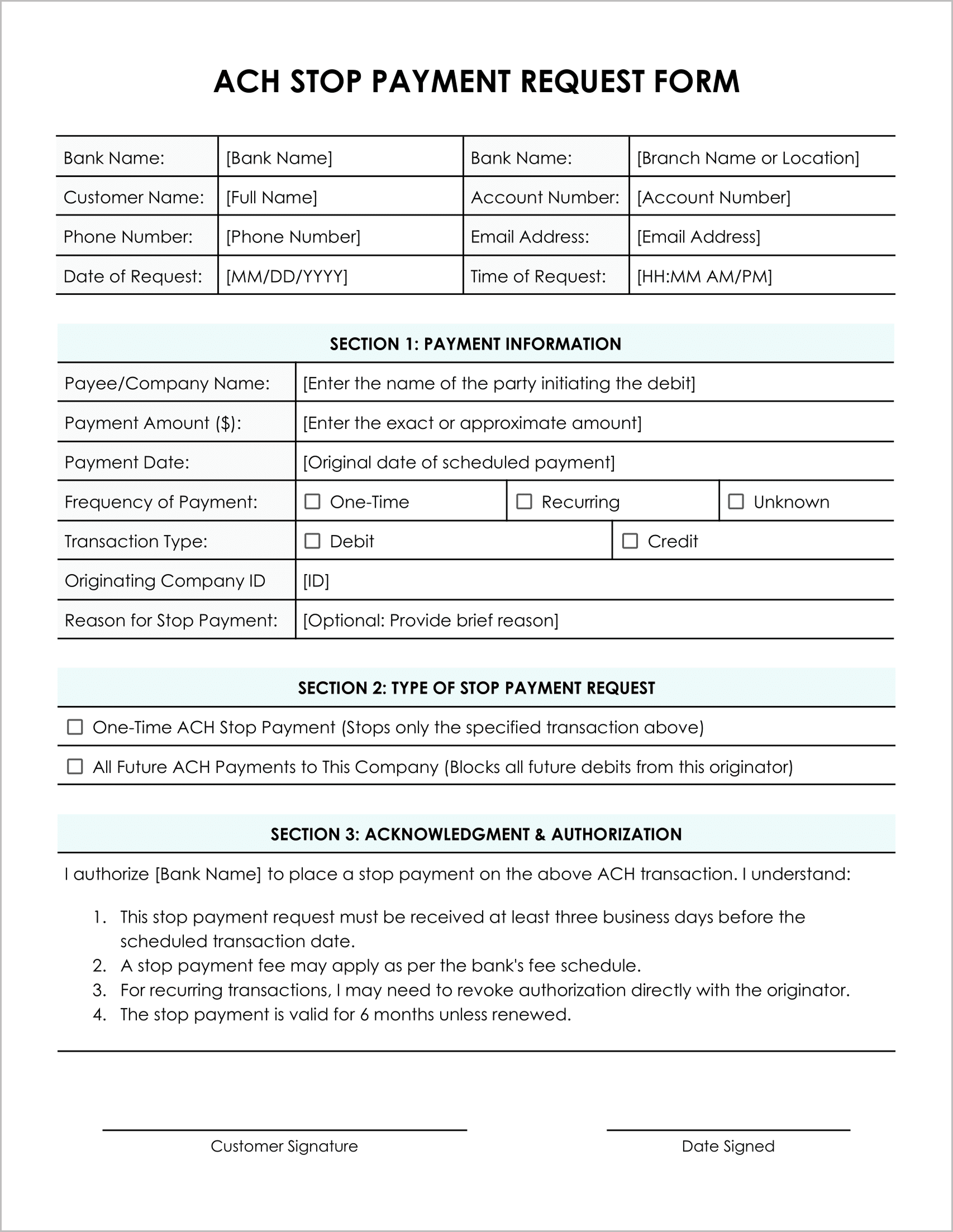

Template 1: Professional Layout

This template has a professional layout, and I have used tables to organize everything. The colors I have used are professional, as this is a professional document.

I have used a black background and white text for the table headers. The header font size is 20pt, while the body text is 11pt, both set in Century Gothic.

You can use any other font, but just a heads-up: this might ruin the template, as this is a very compact form and different fonts have varying character widths, and changing it may cause the content to shift to a second page.

I would suggest keeping the same font, or if you want to change it to a more professional font like Times New Roman, you can do that, but be ready to adjust the template spacing to make it look tidy.

Best for:

- HR and Finance departments

- Banks and Credit Unions

- Legal and administrative offices

Template 2: Minimalist Design

This template has the same content as the previous template. The only difference is that I have removed the side borders of the table to give the form a more minimalistic look.

Also, I have changed the background color of the table header to a very light shade of cyan. The rest of the form is exactly the same.

If you want, you can change the table header color to the color of your choice. You can even change the page color, table border color, font color, etc.

Best for:

- Freelancers and consultants

- Small business owners

- Everyday consumers

Understanding the ACH Stop Payment Form

You now know what and ACh stop payment form is, you have the form too but you need help filling the form or maybe there are certain fields in the document that you don’t understand. This is why I decided to write this section so that it is easy for you to understand the form and fill it correctly.

Below is a detailed walkthrough of each section in the form:

1. Bank and Customer Information

This section is at the top of the form and is the most important section of the form. This section identifies the account holder to make sure the request is routed correctly.

- Bank Name and Branch Location: Enter the full name of your bank and the specific branch name where your account is held.

- Customer Name and Account Number: This is where you enter your full name and the account number. Make sure to double-check the account number before submitting.

- Contact Details: This is where you enter your basic details like your phone number and email address. Make sure these details are the same details you entered while opening the account.

- Date and Time of Request: Here you will enter the date and time of the request. This helps timestamp your request and is important for proving compliance with the bank’s notice period, which is often 3-5 business days in advance.

2. Payment Information

This is the section where you provide all the details about the transaction you want to be stopped:

- Payee or Company Name: Enter the exact name of the company or merchant that initiated the debit from your account. Make sure you are entering the exact legal name as it appears on your bank statement.

- Payment Amount ($): In this section, you have to enter the exact amount. If the amount changes every time (like a water bill), you can mention that the amount “varies” or enter your best guess.

- Payment Date: Enter the date the payment is supposed to happen, or if it is a recurring payment, enter the date it usually happens.

- Frequency of Payment: Select the type of payment; is it a one-time payment or a recurring payment?

- Transaction Type: Select the transaction type, credit or debit.

- ACH Originator ID (Company ID): Enter the unique company ID here. You can usually find this mentioned in your bank statement right next to the company name.

- Reason for Stop Payment (Optional): This is an optional field, but it is helpful to mention the reason on this form. This extra info can help the bank understand your situation.

3. Type of Stop Payment Request

This is section where you tell the bank whether you want to stop just payment or all future payments:

- One-Time ACH Stop Payment: Select this option if you want to stop just one payment from the company.

- All Future ACH Payments from This Company: Select this option if you want to stop all future payments from the company or merchant.

4. Acknowledgment & Authorization

This is the final section of the form and is a very important one. This section explains what happens when you ask the bank to stop the payment and then sign the form to give them to permission to do so:

- Timeliness of Request: Here it is mentioned that the form must be submitted at least 3 business days before the payment is debited so that they can stop the payment. If the money is already debited, they won’t be able to undo it.

- Bank Fees: This process of stopping the payment is a chargeable service, and the bank will charge a nominal fee. This fee will be debited from your account. The fee varies from bank to bank.

- Revocation with Originator: Stopping the payment at your bank does not cancel the agreement with the company; you will also have to notify the company. If you don’t, they might still charge you if it is a recurring payment.

- Validity of Stop Payment: This stop payment request is valid for 6 months. If the company tries to charge you after that, you will have to fill and submit the form again.

- Signature & Date: You need to sign and date this form so that the bank can start the process.

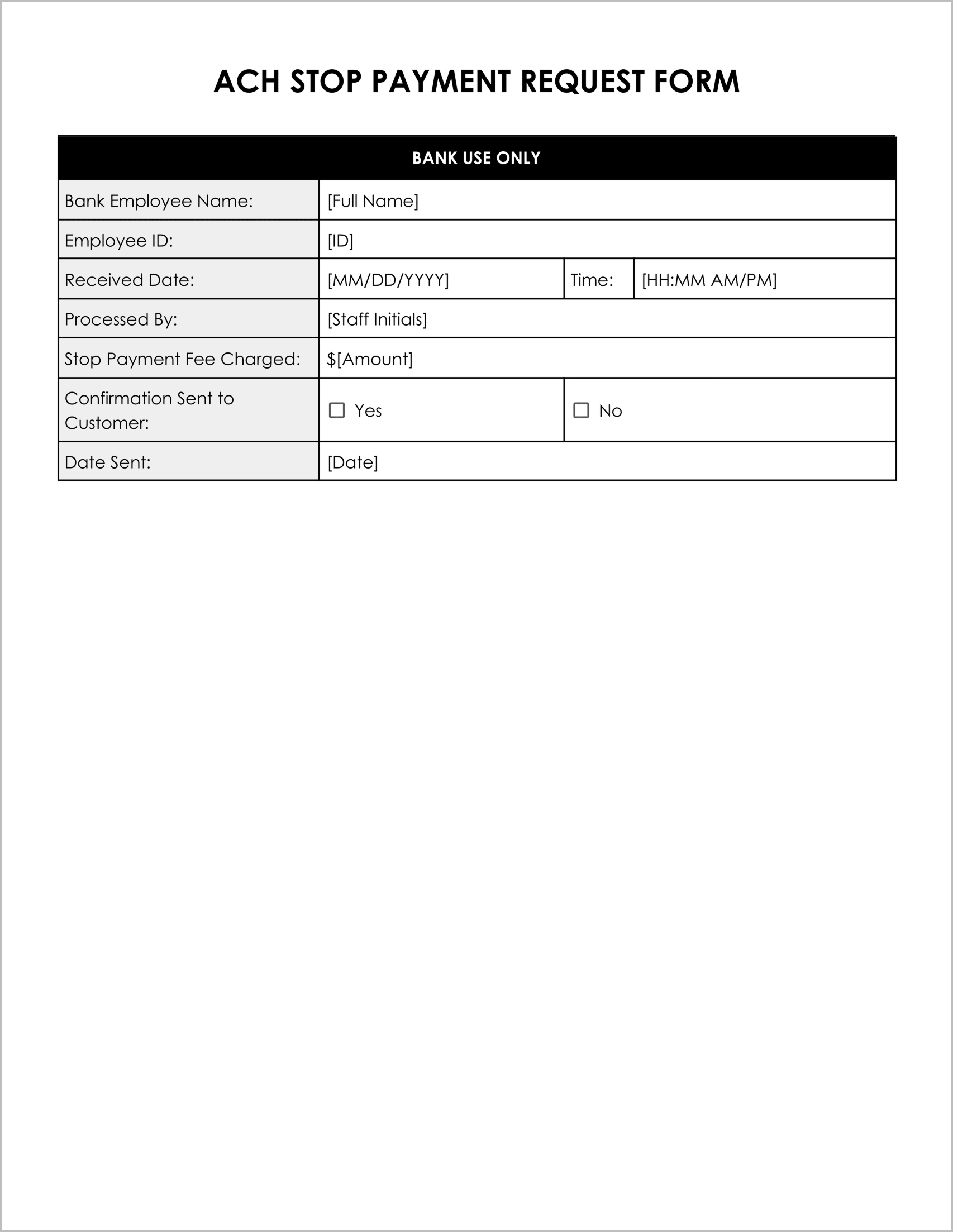

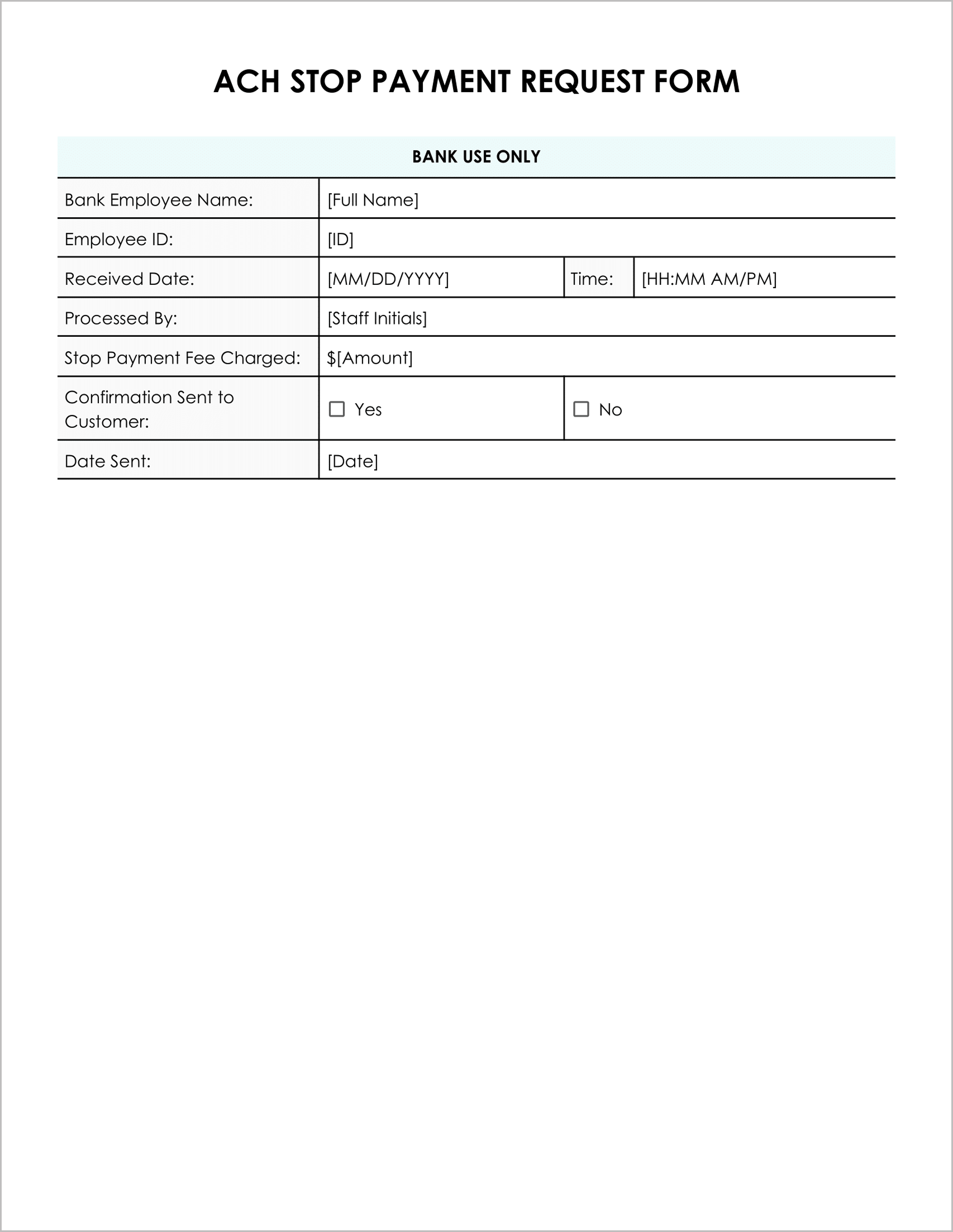

5. For Bank Use Only

This section is not for you but for the bank, and hence I have placed it on the second page. Be sure to print this part as well.

These sections are easy for the bank to understand, as it is their daily task, so I won’t be explaining this section.