Are you looking for a professional, ready-to-use Company Billing Policy Template that outlines your business’s billing procedures in a clear and structured format?

You’re in the right place. While many websites charge for similar templates and often provide them in restrictive PDF formats, we’re offering this editable Google Docs template completely free — no sign-ups, no fees.

You can click the Get this template button below to preview and then hit “USE TEMPLATE” to make a copy and begin customizing it instantly.

Why You Need a Company Billing Policy Template

A well-crafted Billing Policy not only streamlines your internal finance processes but also helps set clear expectations with your clients.

This helps you maintain a healthy cash flow, reduce disputes, and foster transparency across all business relationships.

Our free Billing Policy Guidelines template is designed for startups, agencies, service providers, and small businesses that want to:

- Clarify payment terms and conditions with clients

- Establish a professional invoice generation process

- Set consistent rules around late payments, refunds, and disputes

- Simplify the creation of client billing agreements

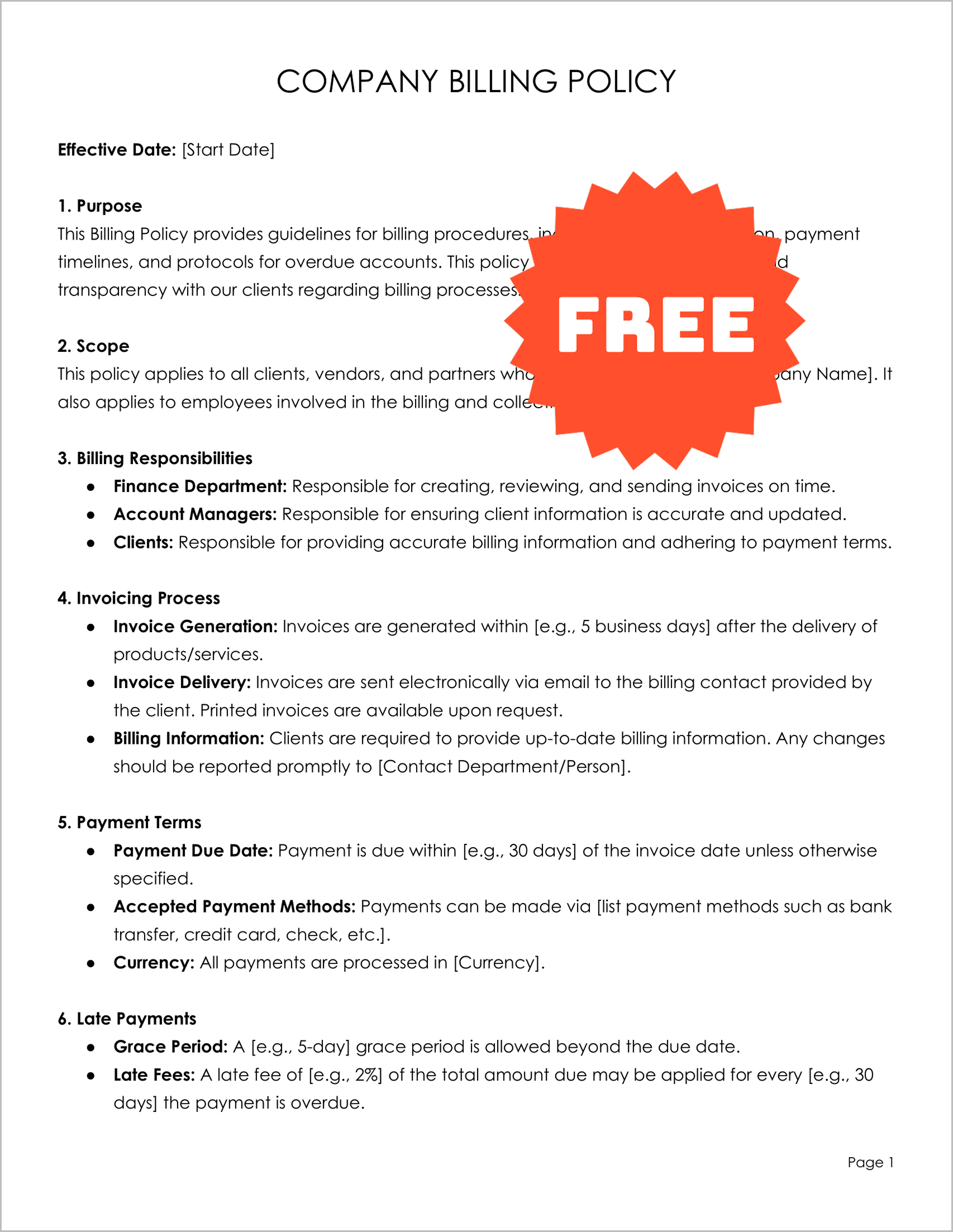

What’s Included in the Billing Policy Template

The template is organized into ten detailed sections that cover all the essential components of a robust billing policy:

Effective Date

Clearly states when the policy comes into effect, allowing for proper documentation and compliance tracking.

Purpose

Explains the overall objective of the policy — to promote efficient billing, timely payments, and transparent client communication.

Scope

Defines who the policy applies to — including your clients, vendors, partners, and employees involved in billing operations.

Billing Responsibilities

Outlines roles and responsibilities for key stakeholders such as:

- Finance Department

- Account Managers

- Clients

This helps ensure that all parties understand their roles in the client billing agreement process.

Invoicing Process

Details every step of the invoice generation process, including:

- Timeframe for invoice creation (e.g., within 5 business days)

- How invoices are delivered (electronically or via request)

- The importance of up-to-date billing information

Payment Terms and Conditions

This section covers:

- Due dates for payments (e.g., within 30 days of invoice)

- Accepted payment methods (bank transfer, credit card, check, etc.)

- Currency used for processing

Having clear payment terms and conditions helps avoid confusion and delays.

Late Payments

Defines policies for overdue invoices, including:

- Grace period (e.g., 5 days)

- Late fees (e.g., 2% per 30 days)

- Service suspension timelines (e.g., after 60 days)

This keeps your revenue cycle secure and predictable.

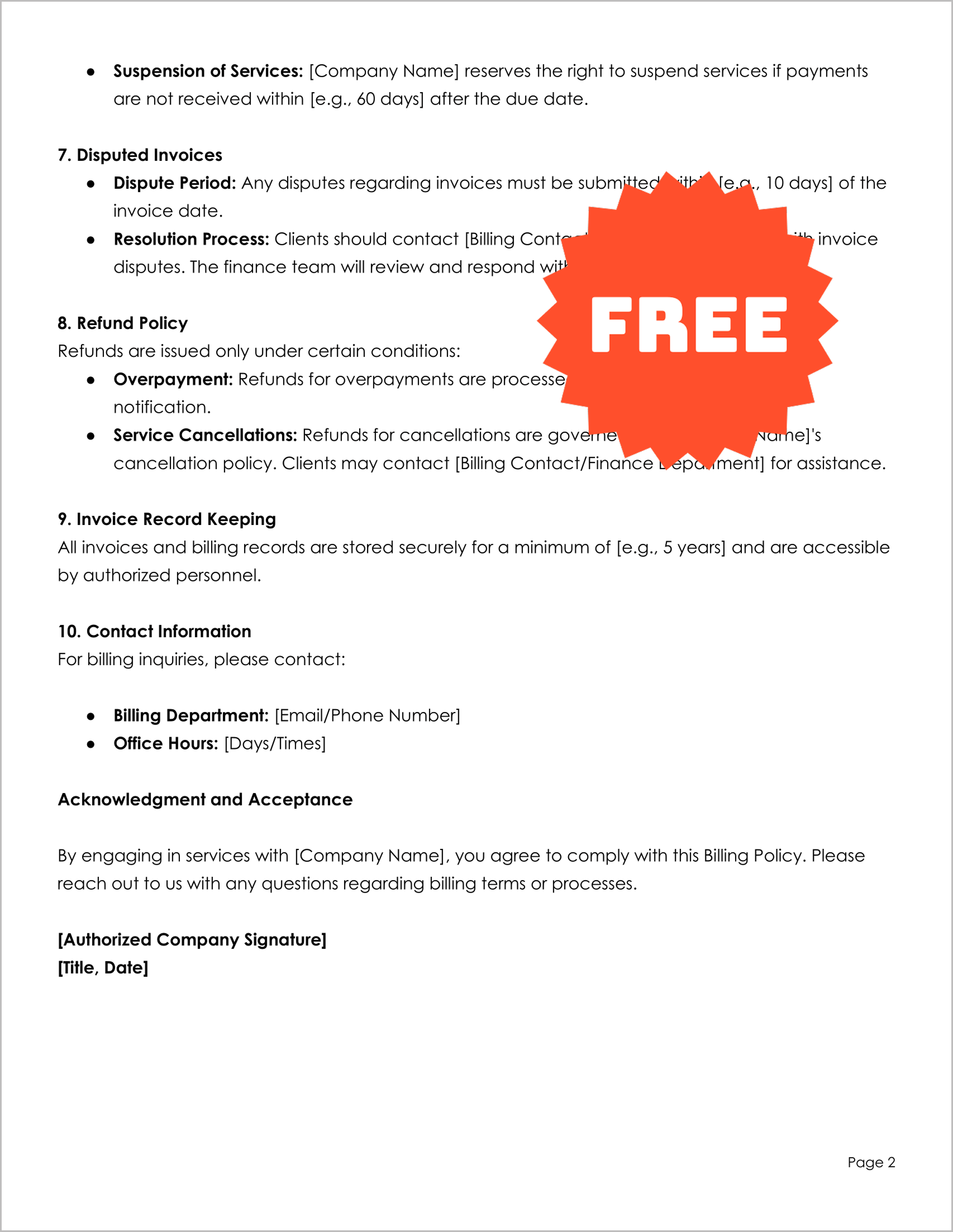

Disputed Invoices

Outlines procedures for handling billing disagreements, including:

- The time window to dispute an invoice (e.g., within 10 days)

- Review and resolution timeline by your finance department

This section protects both parties and encourages prompt communication.

Refund Policy

Explains the refund process in cases like:

- Overpayment

- Service cancellations as per your cancellation policy

Clients can contact your finance or billing department for assistance, making the process smooth and customer-friendly.

Invoice Record Keeping

Specifies how long records will be securely stored (e.g., 5 years) and who can access them. This is especially important for audit and compliance purposes.

Contact Information

Provides clear points of contact for billing questions, including email, phone number, and office hours. This promotes trust and quick issue resolution.

Why Use Our Free Editable Template?

Unlike many company billing policy templates locked behind paywalls or provided only in PDF format, our version is:

- 100% free to use

- Fully editable in Google Docs

- Professionally formatted with all relevant sections

- Easy to customize with your business details

- Quick to implement for any business size

You don’t need to start from scratch — just click Get this template, customize the fields, and you’re done.

Who Should Use This Template?

This template is perfect for:

- Freelancers and consultants

- Agencies and service providers

- Startups and small businesses

- Finance teams creating consistent billing policy guidelines

Whether you’re drafting your first policy or refining your current one, this template saves time and brings clarity to your invoice generation process.

Get This Free Company Billing Policy Template

Click the button below to preview the Google Docs file. Then, hit “USE TEMPLATE” at the top-right to make your own editable copy.

Customize it with your company name, billing contacts, payment policies, and you’re ready to go.