As a payroll manager, you have the crucial responsibility of running a successful payroll process in your organization.

This is indeed necessary for reinforcing human resources and the overall performance of the organization.

Any errors, miscalculations, delays, or unnecessary deductions in the salaries of the employees can raise doubts about the integrity of the whole system and even defame your organization in the future.

You might even end up losing the best of your human assets if you are unable to dispatch the exact emoluments they deserve. But to carry out such a critical process, you need thorough planning and support.

This free Payroll Checklist Template for Google Docs, is an effective tool, enabling you to smoothly conduct the payroll process without any defaults.

Let’s dive into some of the exemplary merits and virtues of this checklist template and how it can help you smartly execute the entire process.

Template Highlights:

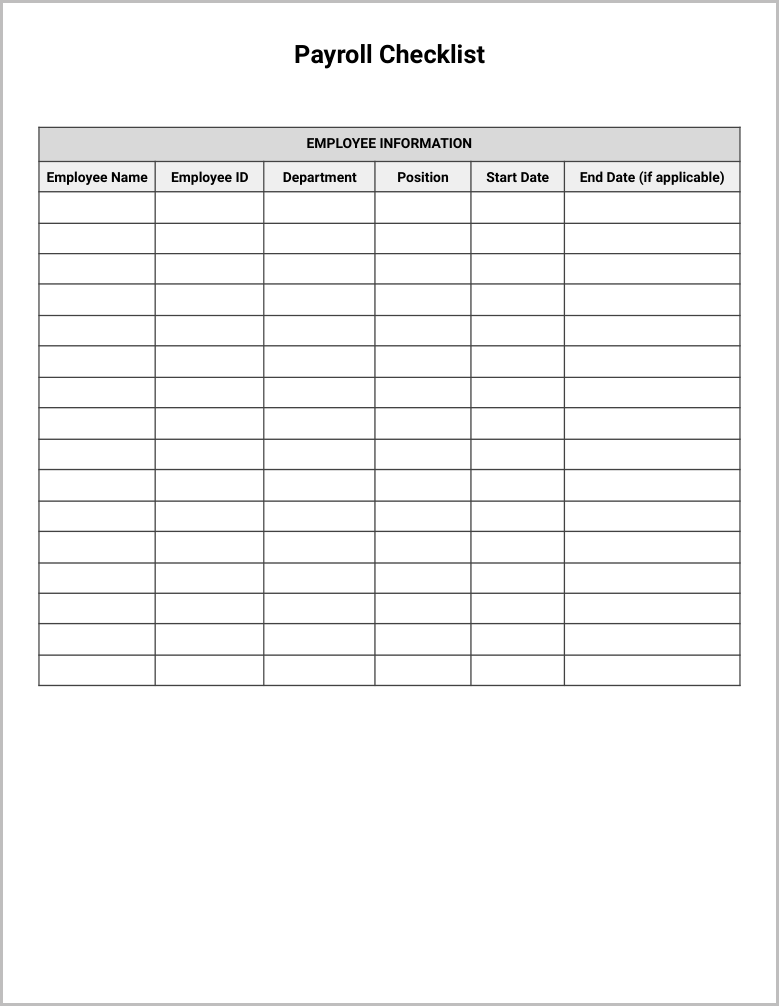

1. Employee Information

- Employee Name

- Employee ID

- Department

- Position

- Start Date

- End Date (if applicable)

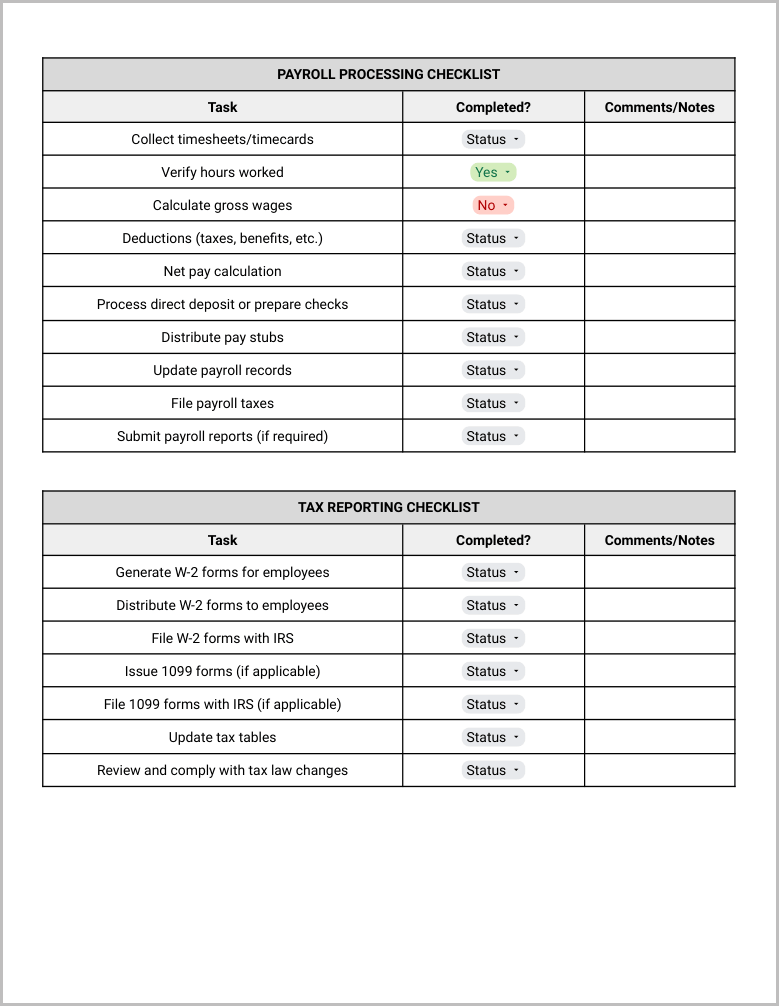

2. Payroll Processing Checklist

- Task

- Collect timesheets/timecards

- Verify hours worked

- Calculate gross wages

- Deductions (taxes, benefits, etc.)

- Net pay calculation

- Process direct deposit or prepare checks

- Distribute pay stubs

- Update payroll records

- File payroll taxes

- Submit payroll reports (if required)

- Completed?

- Yes

- No

- Comments/Notes

3. Tax Reporting Checklist

- Task

- Generate W-2 forms for employees

- Distribute W-2 forms to employees

- File W-2 forms with IRS

- Issue 1099 forms (if applicable)

- File 1099 forms with IRS (if applicable)

- Update tax tables

- Review and comply with tax law changes

- Completed?

- Yes

- No

- Comments/Notes

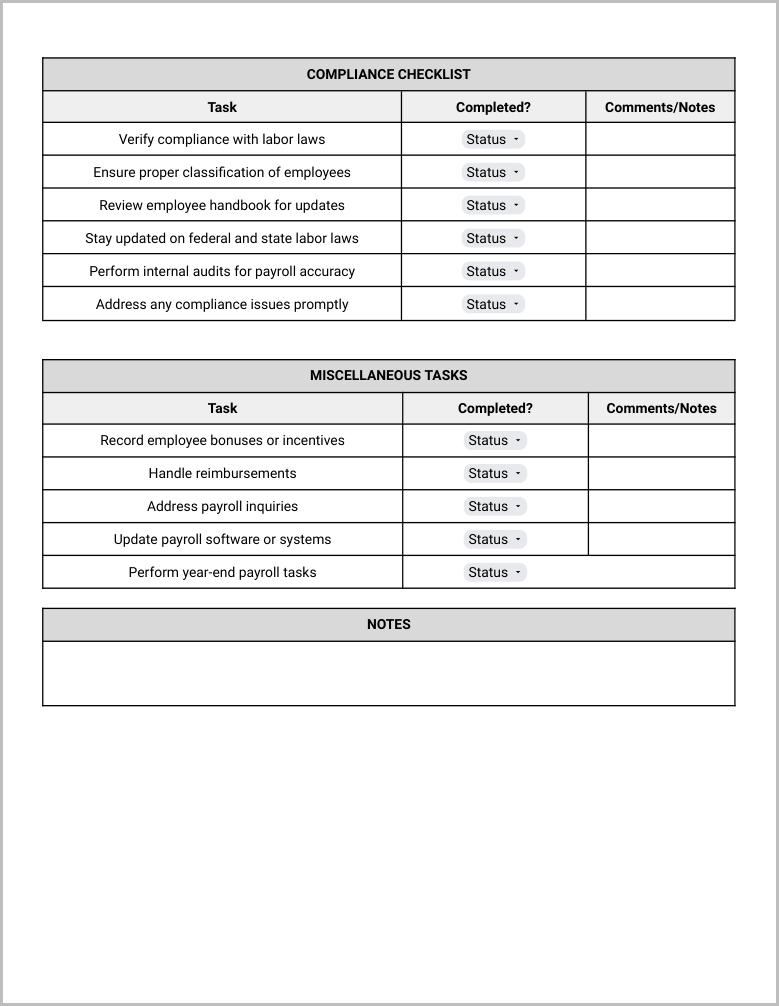

4. Compliance Checklist

- Task

- Verify compliance with labor laws

- Ensure proper classification of employees

- Review employee handbook for updates

- Stay updated on federal and state labor laws

- Perform internal audits for payroll accuracy

- Address any compliance issues promptly

- Completed?

- Yes

- No

- Comments/Notes

5. Miscellaneous Tasks

- Task

- Record employee bonuses or incentives

- Handle reimbursements

- Address payroll inquiries

- Update payroll software or systems

- Perform year-end payroll tasks

- Completed?

- Yes

- No

- Comments/Notes

Template Preview: