If you’re looking for a Tax Matters Agreement Template that is both editable and free, you’ve come to the right place.

While many websites offer similar templates in rigid PDF formats for a fee, we’re providing a high-quality, professional agreement you can copy, customize, and use instantly in Google Docs—completely free.

This editable template is ideal for businesses, joint ventures, and corporate entities that need to document how tax responsibilities are divided and handled between parties.

Whether you’re managing tax filings, audits, or payments, this agreement ensures both sides are clear on their duties.

You can click the “Get this template” button to access the document preview. Then, hit “USE TEMPLATE” to make your own copy and start editing it right away.

Why You Need a Tax Matters Agreement

A Tax Matters Agreement helps avoid confusion, disputes, and legal risks by outlining how parties will manage tax obligations. It’s especially useful for companies involved in mergers, acquisitions, partnerships, or any other joint operations.

This type of Tax Agreement Documentation ensures that each party knows:

- Who files which tax returns

- Who pays what taxes

- Who is responsible for audits

- How tax-related disputes will be resolved

- What happens in case of indemnification

Without a written agreement, misunderstandings can easily arise—resulting in penalties, unexpected liabilities, or legal issues.

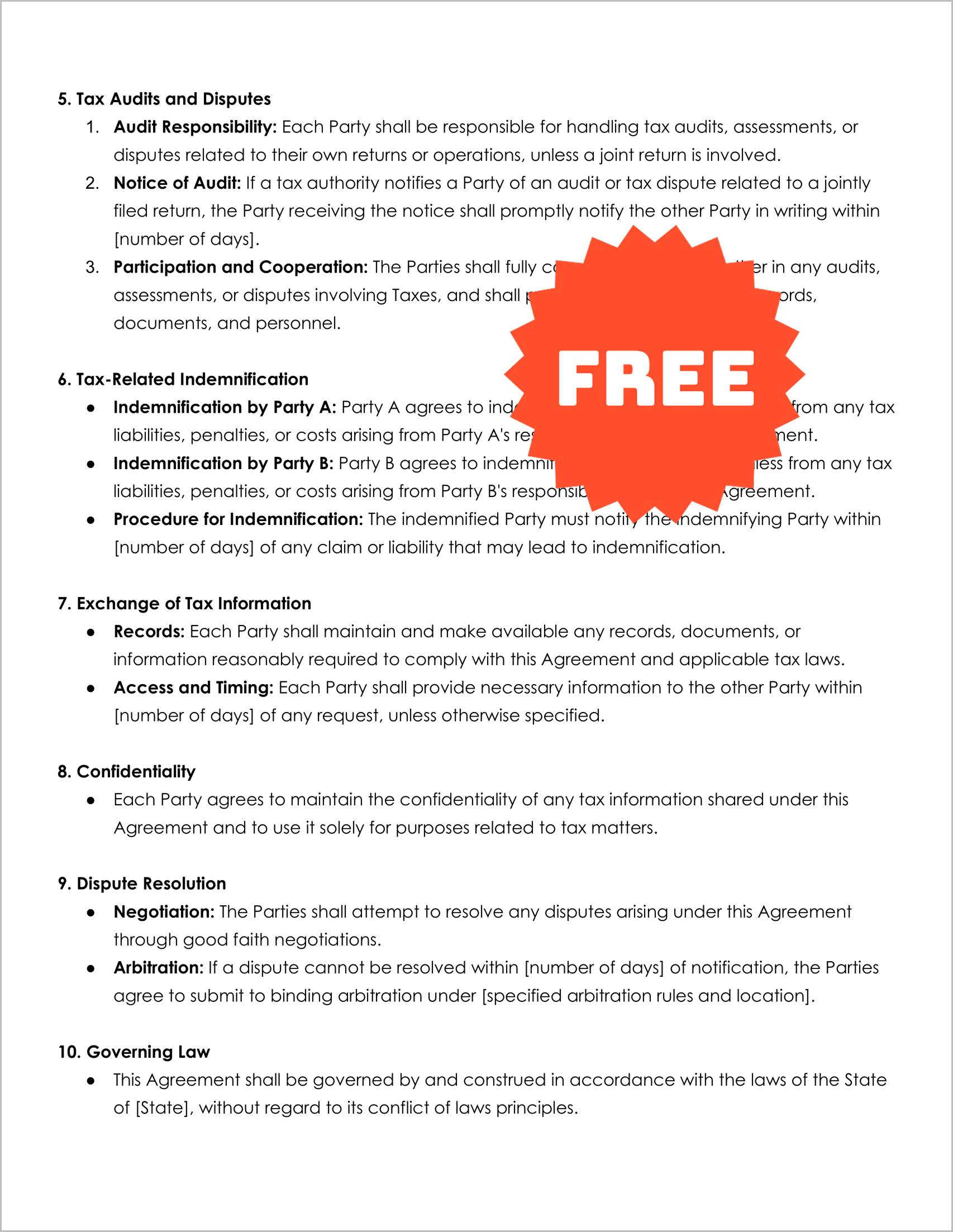

What’s Inside the Template

This Tax Distribution Agreement includes all the essential elements you’d expect in a professionally-drafted legal document:

Purpose

Clearly defines the objective of the agreement—assigning responsibilities related to tax filings, payments, audits, and disputes.

Definitions

Covers terms like “Tax” and “Tax Return” to prevent ambiguity.

Responsibility for Tax Returns

Outlines how each party is accountable for preparing and filing specific tax returns, including the division of labor in joint filings.

Tax Payments

Explains how and when tax payments should be made. Includes provisions for handling payment defaults and reimbursements.

Tax Audits and Disputes

Defines audit responsibilities and sets procedures for notifying and cooperating during tax audits or disputes.

Tax-Related Indemnification

Ensures both parties are protected from the other’s tax missteps through mutual indemnification clauses.

Exchange of Tax Information

Requires each party to maintain records and provide tax-related data upon request.

Confidentiality

Restricts the sharing of sensitive tax information and enforces strict confidentiality terms.

Dispute Resolution

Establishes a clear path for resolving disagreements, starting with negotiation and ending in binding arbitration if needed.

Governing Law

States the jurisdiction under which the agreement will be interpreted and enforced.

Miscellaneous Provisions

Includes legal boilerplate such as severability, counterparts, and entire agreement clauses to make the document airtight.

Who Can Use This Template?

This editable Corporate Tax Planning Document is perfect for:

- Joint ventures and strategic alliances

- Startups with multiple co-founders

- Parent companies and subsidiaries

- Business partners with shared operations

- Entities involved in mergers or acquisitions

Anyone seeking to clearly define tax responsibilities between two parties will benefit from using this agreement.

Free Editable Tax Matters Agreement Template

Unlike static PDF templates offered by other sites, this Google Docs-based agreement is fully editable and customizable.

You can tailor it to meet your specific legal and tax needs without paying a dime. Simply click the “Get this template” link, then select “USE TEMPLATE” in Google Docs to start editing.

The document is professionally structured, easy to read, and covers all legal bases—yet still gives you room to modify details such as deadlines, responsibilities, and governing laws.

Customize It With a Legal Professional

While this template offers a solid foundation for your Tax Agreement Documentation, every business situation is unique.

It’s advisable to consult with a legal or tax expert to ensure the agreement fully protects your interests and complies with applicable tax regulations.

Final Thoughts

A well-crafted Tax Matters Agreement Template can prevent misunderstandings and legal trouble down the road.

Whether you’re dividing responsibilities between co-founders, subsidiaries, or strategic partners, this document gives you the clarity and structure you need.

Start simplifying your corporate tax planning documents today—without spending a penny.